On Tuesday 23rd May we hosted the very first edition of the Projective Group Data Exchange at our London office, where we welcomed a number of data leaders in financial services to discuss the latest trends, issues, and opportunities affecting their businesses today.

In this article we will share our insights on the three most important topics we identified: Operational Resilience, ESG, and ROI.

Operational Resilience: The capabilities required to support OpRes reporting

Ensuring Operational Resilience in the financial sector is important for firms, consumers, and markets alike. As a result, the UK’s Prudential Regulation Authority (PRA) is responsible for creating policies to supervise and regulate the activities of financial institutions. Similarly, the EU has recently released its Digital Operational Resilience Act (DORA) and the US has also issued guidance for Operational Resilience and cybersecurity risk.

With Operational Resilience reporting now a necessity for financial firms, it is important to know the data capabilities required to help facilitate and maximise this process

So, with Operational Resilience reporting now a necessity for financial firms, it is important to know the data capabilities required to help facilitate and maximise this process. When it comes to data management, there are four key foundations that should be incorporated into your Operational Resilience reporting lifecycle.

- Data Governance: This refers to assigning ownership of reporting elements, resolving data definitions, and understanding issues arising from modelling.

- Data Quality: This involves defining and executing data quality rules, addressing data quality issues, and managing the quality of proprietary data.

- Data Architecture: Data Architecture should be used to confirm and capture data definitions, map requirements to the data model, and understand data provenance and lineage.

- Technology Architecture: Technology Architecture should be used to approve implementation of data acquisition transformation, data normalisation, and data enrichment.

ESG Data: The increasing demand and complexity of requirements

Like with Operational Resilience, ESG reporting is now an important requirement for financial institutions. However in this case, with a constantly evolving regulatory landscape for such a broad and subjective topic, organisations are facing a number of challenges when it comes to managing and disclosing their ESG data.

One of the key challenges is what you could call an ‘alphabet soup’ of regulation and reporting requirements. What we mean by this is the wide spectrum of differing regulations and frameworks that are currently in place, making it difficult to know how to keep up with and satisfy them all. Plus, there are now increasing demands from regulators, investors, lenders, and clients for businesses to disclose non-financial data and integrate this into annual reports, which significantly increases reputational and litigation risks from mis-disclosure or ‘greenwashing’.

Another challenge businesses face is the internal management of ESG performance. A key factor here is the current lack of ESG data maturity, given that internal data is often federated across multiple siloes and requires highly manual processing. This is compounded by a scarcity of ESG specialists, especially those with operational, technical, and project management capabilities. In an effort to improve standards of internal management of ESG data, requirements have been introduced to call for stronger data governance, tooling, and management to improve board and external reporting.

Internal ESG data is often federated across multiple siloes and requires highly manual processing.

A third challenge associated with ESG is the increasing demand for ‘Sustainable Finance’ products and services, which has triggered a fundamental rethink of traditional business models and revenue streams driven by opportunities identified from Net Zero. Now, the rapid rise of sustainability-related products and services (for example, issuing a sustainability-linked loan) means that they are not just seen as growth areas, but instead must-haves for profile raising. However, there are significant market data gaps and integrity issues linked to this trend, for example in private, small, and emerging markets.

With so many complexities surrounding ESG data and reporting, it is critical to have a robust data management strategy in place to help achieve compliance, sustainability, and ultimately success for your business.

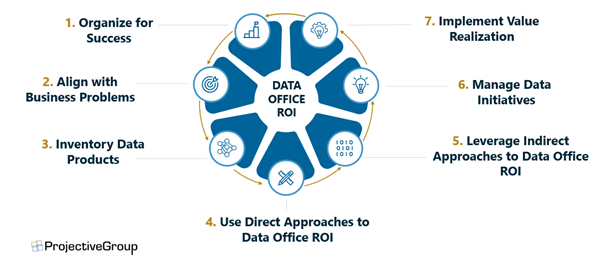

Data Strategy ROI: The 7 steps you need to consider

The value of data within financial services is increasing rapidly, helping to improve decision-making, reduce costs, and enhance the customer experience. However, when it comes to defining the true ROI of data initiatives, it can be difficult to know where to begin. That’s why we have identified the seven most important steps that we believe you should follow.

- Organise for success: Before you begin, you need to make sure your internal processes and people are set up for success. This includes establishing product teams, building financial literacy, and formulating change management.

- Align with business problems: The next step should be building a stakeholder map, prioritising your business problems, and identifying relevant regulations.

- Inventory Data Products: Inventory your data products by developing a data product hierarchy and mapping the financial value of each.

- Direct ROI Calculation: Select a methodology, develop your business cases, then apply appropriate adjustments (including for Data Quality).

- Indirect ROI Calculation: Allocate revenues or earnings to the Data Office, build a data portfolio ROI, and develop Data Office KPIs.

- Manage data initiatives: Map all data products and enterprise system initiatives, implement data governance, and periodically measure against Data & Analytics models.

- Implement value realisation: Establish a value realisation office and align the soft and hard monetary benefits.

If you would like to find out more about these topics, or any of our other areas of expertise, you can get in touch with our team today. Plus, if you are interested in attending any of our future knowledge-sharing and networking events, leave your details here to get an invite for our upcoming editions.

About Projective Group

Established in 2006, Projective Group is a leading Financial Services change specialist. With deep expertise across practices in Data, Payments, Transformation and Risk & Compliance.

We are recognised within the industry as a complete solutions provider, partnering with clients in Financial Services to provide resolutions that are both holistic and pragmatic. We have evolved to become a trusted partner for companies that want to thrive and prosper in an ever-changing Financial Services landscape.