The financial revolution in Europe is in full swing, with implications for almost all participants. With the possible introduction of Central Bank Digital Currencies (CBDCs), tokenised bank deposits, and trigger solutions, the financial system expects a fundamental change.

A CBDC, as a central bank currency, is a digital form of fiat money issued by a central bank and operates on the infrastructure of a distributed ledger technology (DLT). The decentralized management of money plays a crucial role, meaning that the technology does not centralise the management of money in one place, such as a bank, but distributes tasks like storage and verification to various computers. Information blocks are chained together, with each new transaction generating a new block. Each new block is verified, resulting in a transparent and consensus-based immutable ledger. These assets are stored in a wallet by cryptocurrency holders.

Unlike currently established cryptocurrencies, a CBDC is controlled by the central bank and thus serves as a legal and recognised means of payment.

In contrast to currently established cryptocurrencies, a CBDC is controlled by the central bank and serves as a legal and recognized means of payment. The exact design of the CBDC, its introduction date, and the underlying infrastructure for Euro CBDC transactions are currently under discussion and strategic development. The following contents reflect the current state of considerations in the market and aim to contribute to ongoing discussions.

The Euro CBDC as the digital representative of the euro

When considering CBDCs, the following potential forms should be taken into account:

Retail CBDCs (also known as rCBDCs) are designed for use by households and small businesses, primarily for everyday transactions. They would be accessible through digital wallets and could be used for purchases from merchants. Compared to traditional payment methods, the advantages lie in providing a faster and cheaper means of payment than cash.

Wholesale CBDCs (also known as wCBDCs) are designed for use by financial institutions for interbank transactions. They could be used for the settlement of securities and foreign exchange transactions, from clearing to liquidity management. A wCBDC would enable payment against delivery, which could reduce settlement times and counterparty risk.

Synthetic CBDCs (also known as sCBDCs or hybrid CBDCs) represent a tokenized form of money issued by banks and savings banks, fully backed by central bank reserves of the respective bank, thus maintaining the security of the settlement assets. They would create a digital twin of central bank money and work in a complementary manner.

Therefore, CBDCs are intended to be used as a medium of exchange, store of value, or unit of account, providing access to central bank money for households. At the same time, the goal of the ECB is to prevent capital outflows from Europe and thus maintain the stability of the euro. Additionally, it is of interest to the ECB that funds continue to flow through European infrastructures, allowing the central bank to maintain its authority.

All CBDCs offer the advantage of running on a DLT-based infrastructure, with programmable payments such as smart contracts promising significant process harmonisation and increased efficiency.

From a strategic perspective, all CBDCs offer the advantage of running on a DLT-based infrastructure, allowing programmable payments such as smart contracts to bring about significant process harmonisation and increased efficiency. Furthermore, the increased transparency associated with the technology can prevent or trace topics such as money laundering, anti-terrorism financing, or other criminal financial transactions.

Beyond CBDCs, tokenised bank deposits are also being discussed, which could elevate the industry to a new level.

Bank money tokens as a lever for Industry 4.0

Bank money tokens are digital, tokenised representations of bank balances that can be issued by banks and savings banks. They can also be used for transactions and are tied to the value of the underlying bank balance.

In addition to the previously mentioned CBDC possibilities, this form of currency also allows for nano payments, making it easier to implement business models such as pay-per-use. Tokenised bank deposits can also help accelerate payment transactions as they can be transferred quickly and easily or enhance liquidity indicators by being used as collateral for loans, for example.

This form of payment promises a significant step towards Industry 4.0 and the Internet of Things (IoT) and would be a great achievement for the visions of smart cities or the machine-to-machine economy.

Smart Contracts for Smart Business

To bridge the gap between business transactions and the flow of payments, a trigger is needed, such as a smart contract.

A smart contract is an automated system that triggers a pre-programmed action when certain conditions are met. For example, a loan in tokenised bank deposits could be issued when a company has been approved for a loan and has submitted verified documents. This example can be extended to the automation of application processes, document verification, or credit checks through smart contracts, revealing the optimisation potential hidden within a single business transaction. Considering the potential in other industries to make existing processes more interoperable, they appear as a large iceberg covering the path to efficiency.

What challenges need to be overcome?

As with any great opportunity, there are also significant challenges involved. The metaphor of the iceberg is quite fitting here, as CBDC and tokenized bank deposits are currently in the early stages of their definition and exploration phase. Various governance models for tokenized bank deposits are currently being discussed, and no technical onboarding has taken place yet. Furthermore, no classification of tokenized bank deposits has been determined. Whether they are considered deposits, e-money, or stablecoins will entail different regulatory requirements - questions that are tied to further development processes.

For CBDC, requirements and framework parameters have been defined so far. For example, it has been established that the digital Euro should remain non-interest bearing, just like cash. However, it is not yet clear what amount of CBDC users will be allowed to hold in their wallets. As the acquisition of CBDC requires the exchange of bank deposits for (digital) central bank money, the ECB wants to prevent a "bank run" through an as-yet-to-be-defined upper limit. The currently discussed maximum amount should be as high as necessary and as low as possible.

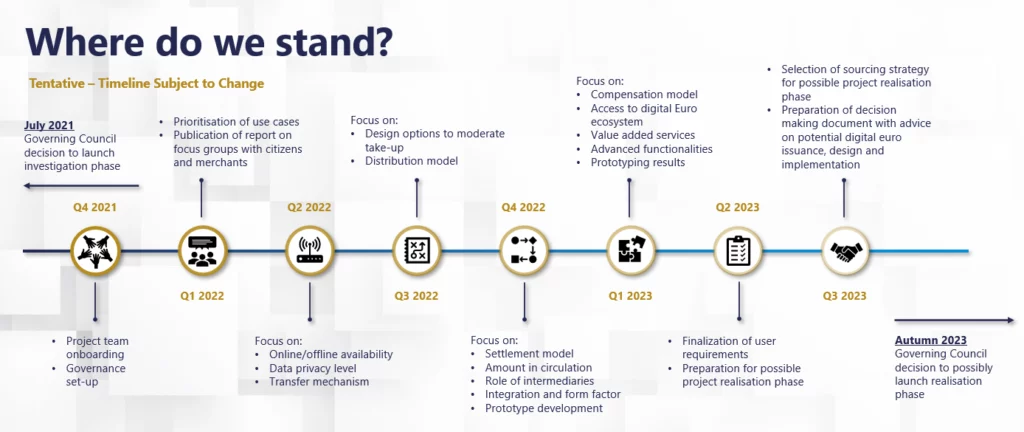

The ECB has set the following provisional timetable for the conception of the digital Euro:

CBDCs should not be programmable to avoid manipulation or other illegal activities, which makes it a complex endeavour considering programmable payments like Smart Contracts. Additionally, there is the issue of designing the technical infrastructure, which could pose a significant hurdle.

Since DLTs (Distributed Ledger Technologies) such as blockchain are known for their transparency due to the traceability within a chain, ensuring the anonymity of money presents a major challenge.

Conclusion

The ecosystem of CBDCs, tokenised bank deposits, and Smart Contracts offers enormous potential for the European economy to meet the increasingly complex challenges of digitisation in the financial sector. It also provides significant opportunities for automation, transparency, and time and cost efficiency.

Banks play a crucial role as intermediaries, especially in payment transactions, which is the focus of the ECB's ambition and conception.

As the overall construct of CBDC is in a very early regulatory stage, it is currently important to monitor the developments by the ECB. In addition, banks must promptly determine the extent to which they want to participate in a DLT-based banking world. To do so, it is of great importance to develop the affected use cases and potentially design new applications - for which we gladly offer our consultants who have already gained extensive experience in similar projects.

It remains to be seen whether these possibilities can overcome the upcoming hurdles, but the potential is undoubtedly there. The question is what role banks want to play in this vision.

About Projective Group

Established in 2006, Projective Group is a leading Financial Services change specialist. With deep expertise across practices in Data, Payments, Transformation and Risk & Compliance.

We are recognised within the industry as a complete solutions provider, partnering with clients in Financial Services to provide resolutions that are both holistic and pragmatic. We have evolved to become a trusted partner for companies that want to thrive and prosper in an ever-changing Financial Services landscape.