With our compliance software Ruler and our Regulatory Updates, we update clients on new and changing laws and regulations. In an earlier article, we discussed the regulatory burden for investment fund managers. We concluded that the regulatory burden for those parties is enormously high. But does this also apply to other financial institutions? What has happened in the past three years for the entire sector? In this article, we take you through a look back at the changing regulatory landscape, and la ook ahead to the future. It seems, as might be expected, that we are getting busier and busier.

Table of content

About the enquiry

In 2020-2022, using our compliance software Ruler, we published 1776 alerts with relevant information for various financial institutions. These alerts are both sector-wide and institution-specific. Ranging from the European Banking Authority (EBA) publications on Anti-Money Laundering (AML) regulations and delegated regulations with prudential rules for banks, to news items for trust offices and Q&As for payment service providers. In short, everything published both in the Netherlands and in the EU. We have categorised these publications into different themes. For instance, we have categorised notices in respect of MiFID II and IFR/IFD that specifically apply to investment services and/or activities under "investment firm" and placed rules on the Sustainable Finance Disclosure Regulation (SFDR) and AML6 that affect multiple financial institutions under ESG and AML.

Excess of prudential regulation

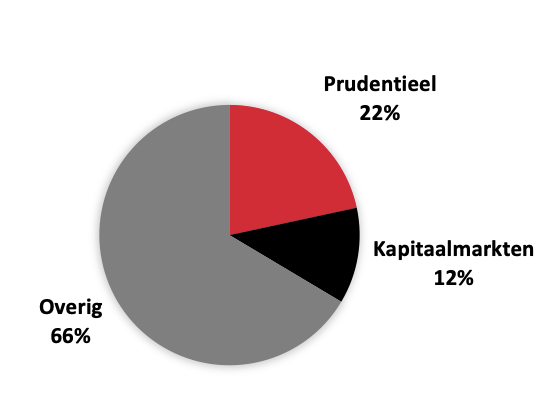

Of the 1776 alerts, a whopping 22% (384) consisted of multi-agency publications around prudential laws and regulations for banks (prudentieel). This theme deserves a consideration in itself, and is therefore continued in another article. The same applies to the topic of capital markets (kapitaalmarkten), which covers some 12% (212 alerts) of publications. Here one can think of rules on benchmarks, EMIR, securitisations, CSDR, etc. In this article, we look at the remaining 66% (overig), which is still some 1180 publications relevant to the financial sector.

The EU has the upper hand

As might be expected, in recent years we see that Dutch regulators (the AFM and DNB) publish less than European bodies. AFM and DNB together published 207 publications relevant to the financial sector. European regulators (the ESAs: EBA, ESMA and EIOPA) published as much as twice as many in the same period. This is only expected to increase, partly due to the European AML regulator (AMLA) proposed by the European Commission. The AMLA will oversee financial institutions both directly and indirectly.

* Note that this pie chart does not include the number of publications on prudential regulation for banks. This makes it seem like the European banking regulator (EBA) is keeping relatively quiet compared to ESMA, but nothing could be further from the truth.

Does this mean that Europe actually has more influence? Or is there room for interpretation, and can Member States interpret European legal frameworks themselves? This depends on whether they are regulations (which have direct effect in member states) or directives (where it is about achieving a goal, but member states are allowed to decide how to achieve that goal). In the past three years, some 159 new and amended (delegated) regulations and directives have been published. You guessed it... 81% or four out of five publications were (delegated) regulations. We see this reflected in many regulations, one can think of the SFDR, DORA, but also the new anti-money laundering regulation (AMLR).

Silence before the storm for crypto service providers?

Below, we take you through some notable findings that require additional explanation. First, the regulatory burden for investment firms remains enormous, including with the arrival of the prudential framework (IFR and IFD).

Second, the number of publications for crypto service providers is lower than expected. The attention recently drawn to these institutions from regulators suggested that a lot is also happening in the regulatory field. Yet only 3% of the publications focused on crypto service providers. This can be explained by the fact that crypto service providers are not yet subject to specific regulations, which means they are also not yet under supervision. But that framework is coming with the Markets in Crypto Assets Regulation (MiCAR). However, this does not mean that there is currently nothing for crypto service providers to do, as they do have to comply with sector-wide AML regulations.

The regulation of crypto service providers is still very new compared to the rules for other financial institutions, so it is likely that the amount of regulation will increase in the coming years.The Ministry of Finance launched two consultations on 14 July 2023 on the "Market in Crypto Assets Regulation Implementation Act" and the "Regulation Implementation Act on information to be added to transfers of funds and transfers of crypto assets". This second bill aims to amend the Wwft and the Sanctions Act 1977.

Green, greener, greenest

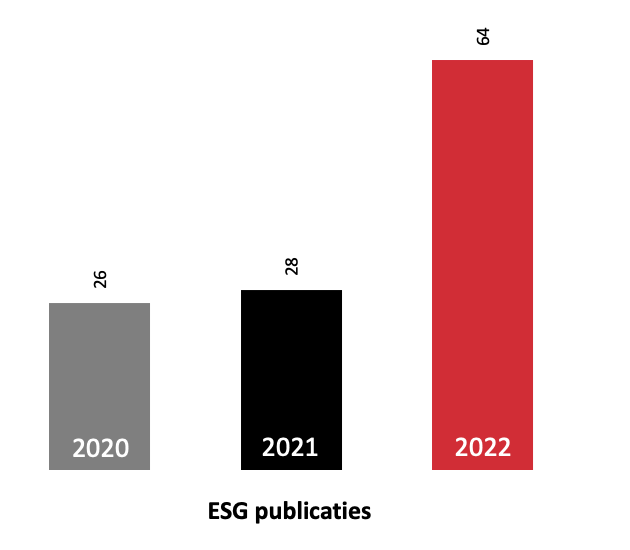

In 2019, the European Commission (EC) published the European Green Deal to help the EU make the green transition, with the ultimate goal of climate neutrality by 2050. This focus on sustainability is certainly reflected in the number of publications. Indeed, one in ten publications is about ESG (Environmental, Social & Governance). One can think of the Taxonomy Regulation coming into force on 1 January 2022, or the publication of the final delegated regulation on the Taxonomy Regulation. In addition to the Taxonomy Regulation, the Delegated Regulation on the SFDR has also been published.

Several bodies have issued Q&As and guidance documents on how to interpret and implement these regulations in response to these publications. It is to be expected that the focus on sustainability will continue to increase. In the past year, the number of publications on ESG has doubled. This exponential growth is likely to continue in the coming years. On 14 September 2023, for example, the EC launched another two consultations on the implementation of the SFDR, asking questions about, among other things, how the SFDR has been implemented, possible shortcomings and the interaction with other European sustainable regulations.

What's next?

In our research, we analysed the relevant laws and regulations of the past three years. What does this retrospective promise for the future? It may be clear that regulations coming at the financial sector will continue to increase in the coming years.

DORA

DORA came into force early this year and from 17 January 2025 this legislation will apply to (almost) the entire financial sector. DORA aims to secure institutions' digital systems and networks and create a harmonised legislative framework. Despite the fact that 2025 still seems far away, the AFM advises to start working on this legislation now. In a series of publications, the first of which was published on 20 July 2023, the regulator will provide practical tips on how institutions can best do this in the coming months.

AIA

In line with DORA, another high-impact regulation can be expected to come into force in the near future: the Artificial Intelligence Act. This regulation will affect all market participants that use or will use artificial intelligence in the near future. This will involve guarantees about the security of the systems, guarding standards and values applicable within the EU, but also facilitating investment and innovation in this field.

CSRD

Furthermore, in the field of sustainability, we see the Corporate Sustainability Reporting Directive (CSRD) gradually coming into force. The CSRD is the successor to the Non-Financial Reporting Directive (NFRD). The NFRD requires covered companies to disclose non-financial reporting. The CSRD aims to increase the flow of sustainability information in the corporate sector. Compared to the NFRD, the CSRD would result in the following substantive changes, among others: mandatory auditing of information published under the CSRD; more detailed reporting requirements; and mandatory use of EU-wide reporting standards (ESRS). A huge source of additional regulatory burden, therefore.

PSD3

The arrival of Payment Service Directive 3 (PSD3), the Payment Service Regulation (PSR) and the Financial Data Access Framework (FIDA) also brings changes for the industry. And so not only for payment service providers. Indeed, the latter will also apply to financial institutions acting as data holders or users of customer data.

Although this article contains only a small sample of the many, big changes that await us in the coming years, the picture painted is clear. The financial sector will also have to continue to comply with new, complex regulations in the coming years.

Want to know more?

Compliance software Ruler helps you keep track of the rapidly changing financial laws and regulations. The legal framework offers an overview of all laws and regulations that apply to your organisation, clearly divided into topics and themes. Ruler also keeps you informed of (upcoming) changes, so you are never confronted with surprises. Curious about what Ruler can do for your organisation? We would be happy to give you a demo.

Would you prefer a quarterly personal update on the developments relevant to you? Our specialists will gladly provide you with a custom-made Regulatory Update. This comprehensive report provides an overview of current affairs, legislative changes, regulatory publications and consultations, and is fully tailored to your organisation and activities.